Pay superannuation for your employees with more ease

Automatically track, make, and report your superannuation payments via our powerful payroll engine.

You’ve just found a superannuation solution that’s embedded in payroll

Since all of our onboarding, rostering, time and attendance, and payroll features are built in one system, you’ll be able to calculate employee superannuation entitlements throughout the pay cycle.

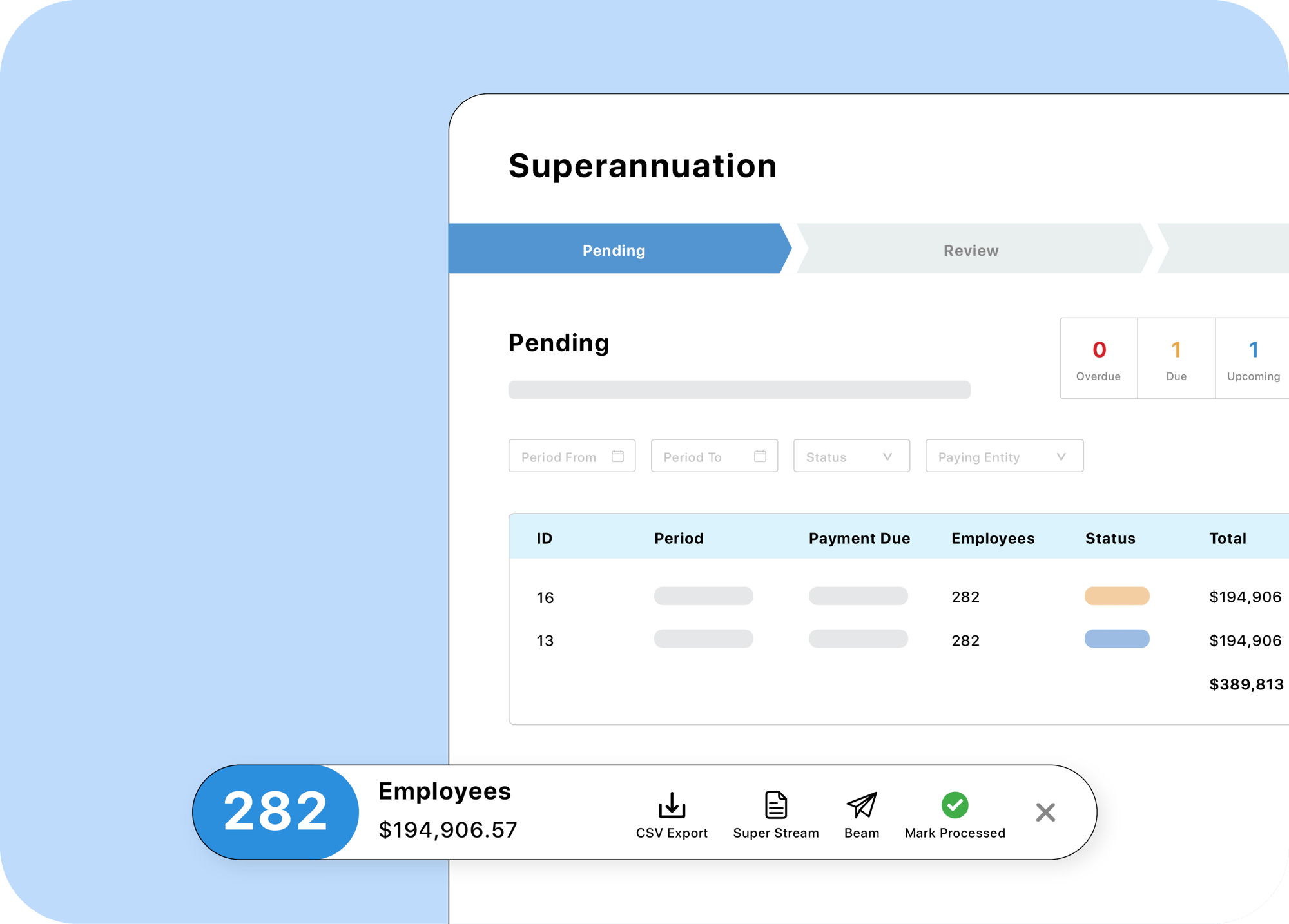

Stay on top of your commitments

Easily accrue, track, and report on your superannuation liabilities in detail with our easy to use superannuation portal.

Prepare for Payday Super

Make swift and secure super payments and meet the upcoming payday super requirements starting in July, 2026.

Make error free super payments

Get notified when the superannuation payment date approaches and proactive alerts when batches contain errors.

Automate superannuation accruals

Superannuation automatically accrues in foundU. As shifts are worked and approved, the hours will flow straight through to payroll via our powerful award interpretation and pay rule engine. Superannuation payments required for each employee will show up on their pay slips and accrue in our streamlined superannuation payment portal. View super batches and make payments directly from the platform at your chosen interval.

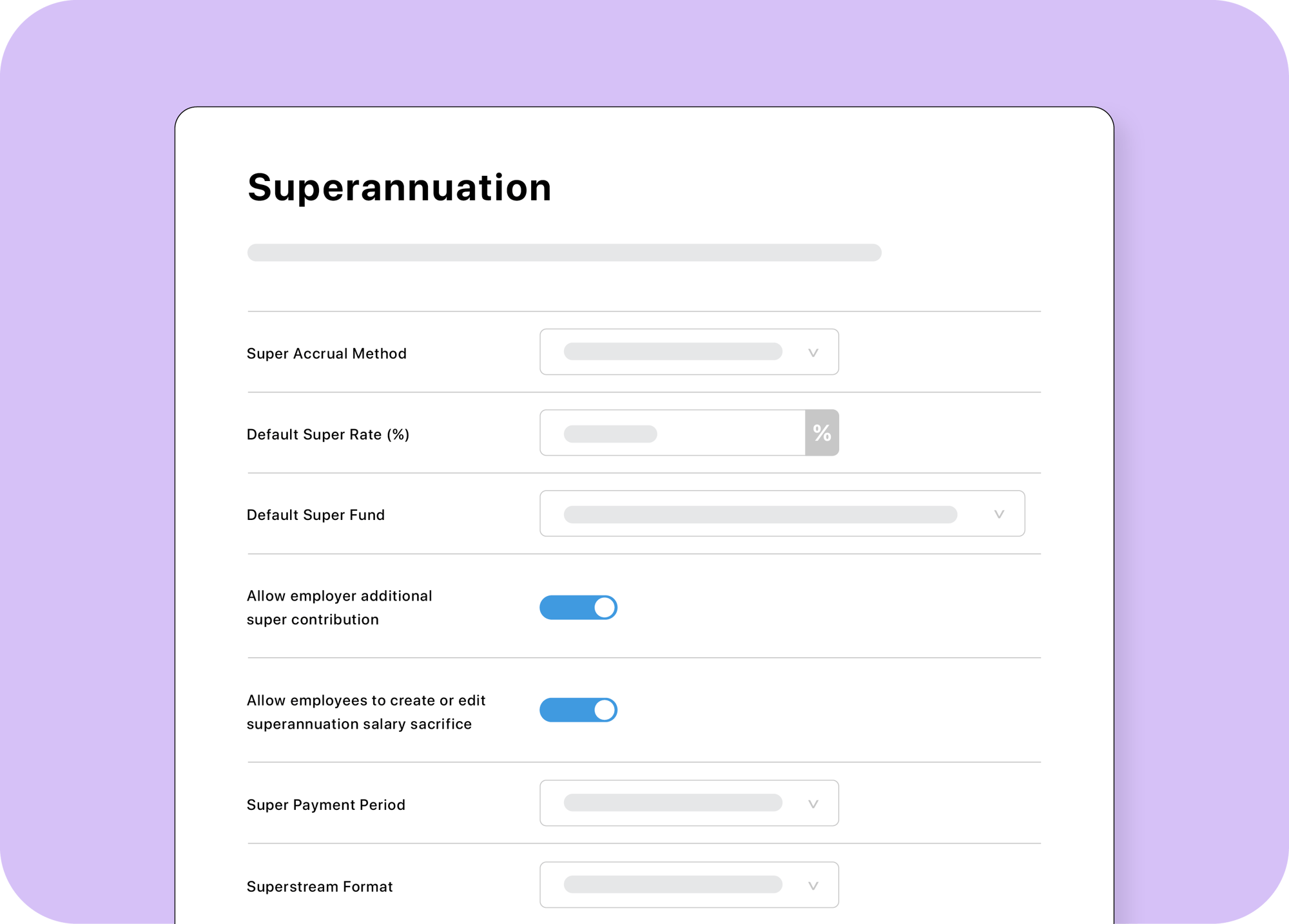

Improve your compliance with superannuation requirements

Set your accrual method and payment frequency via our convenient settings. You will then receive notifications when the superannuation payment date approaches, as well as alerts for any overdue batches or errors, such as outdated funds. You can also see accruals for individual employees, making it easy for you to run checks, ensure compliance, and make timely payments.

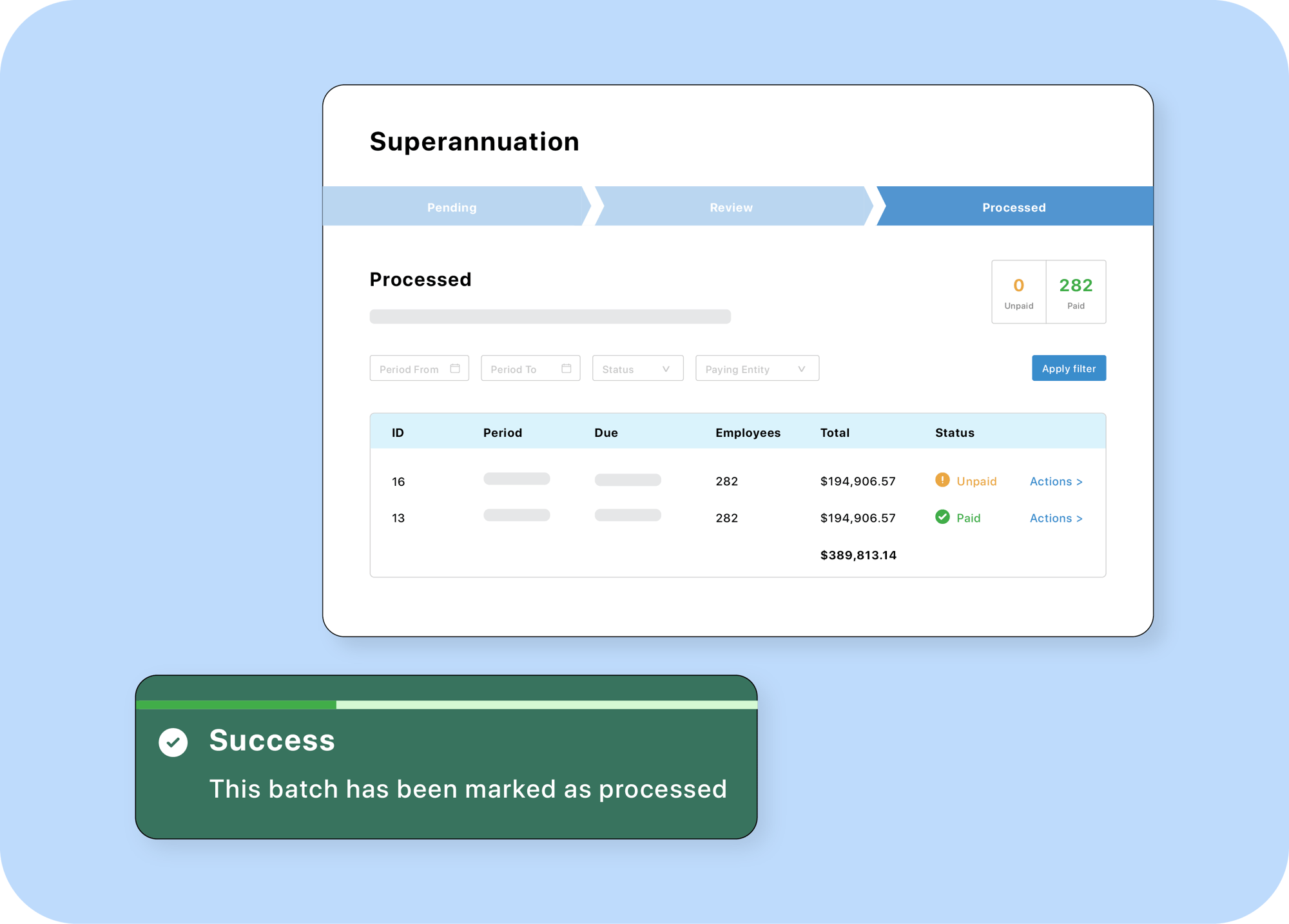

Make super payments with ease

After reviewing your superannuation batches, you can make payments in a matter of clicks. Easily upload your Superstream file to your chosen clearing house and keep track of payment status. Or, you can use the Beam integration to pay your employees’ superannuation straight from the platform. The clearinghouse will speed up your superannuation payments at no extra cost to you and will prepare you to meet the new Payday Super requirements starting in 2026.

Tax, superannuation, and all entitlements are easily accounted for and reconciled. As the Managing Director, I feel very in control of my business operations.

Lorem ipsum dolor sit amit

Frequently asked questions

Do employers have to pay their employees super?

Yes. In Australia, employees are entitled to a Super Guarantee (SG). Under this scheme, employers are required by law to contribute a percentage of their employees’ ordinary time earnings into the employee's superannuation fund of choice.

How often do employers have to pay superannuation?

In Australia, super currently has to be paid at least every three months into the employee’s nominated account. Payments must be received by the employee’s fund on or before the quarterly super due dates, at least four times a year. You can find more information about Fair Work’s requirements here.

What is Payday Super?

Payday super is a new requirement that will be introduced by the Australian Government in July, 2026. Employers will be required to make and report SG contributions at the same time they pay salary and wages, replacing the current requirement to pay super quarterly.

Since this will increase the frequency of superannuation payments and reporting, many employers will look for streamlined superannuation payment solutions.