Earned Wage Access

Earned Wage Access

Provide flexible earned wage access and financial wellbeing tools for your employees with our Wageflo tool.

Switch on earned wage access for your employees

Facilitate pay on demand via your payroll platform with no cost to your business and without the debt, interest, or overdraw risk for your employees.

Immediate earned wage access

Life doesn’t always go to plan. Relieve financial pressure on your team and provide immediate access to earned wages when the unexpected arises.

Employee budgeting tools

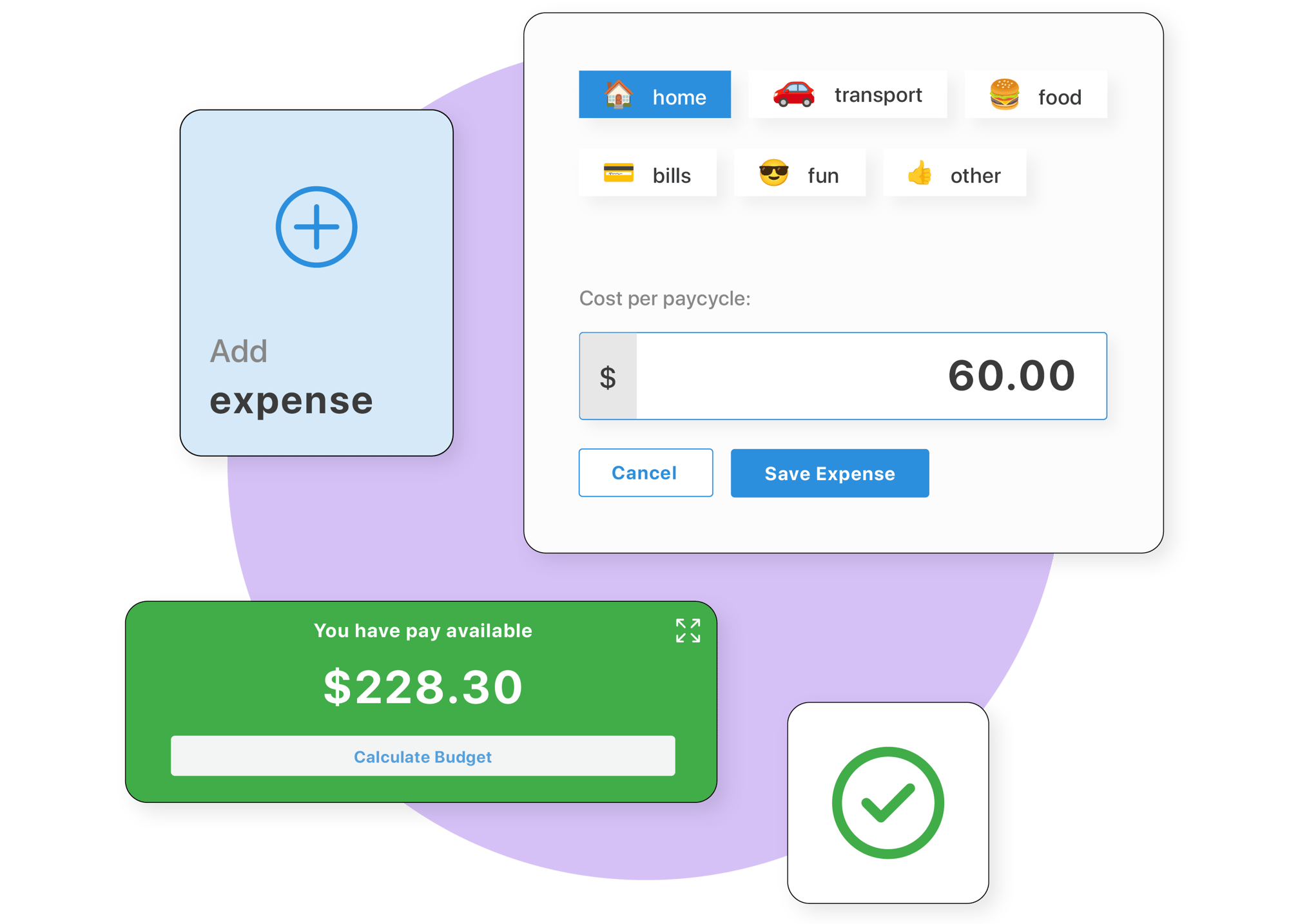

Help your employees create a budget, make plans based on their future earnings, and improve their financial wellbeing.

Leverage real-time wage data

Use continuous award interpretation and approved shift data to automatically calculate net entitlements.

Employees can access earned wages with just a few clicks

Rather than having to wait for their scheduled pay day, your employees can request immediate access to a percentage of their pay after their hours have been worked and approved. We fund the early access, automatically apply a deduction with a flat $5 transaction fee from their next pay slip, and recoup the amount when you process pay.

Complement earned wage access with employee budgeting tools

Our self-serve employee app also has budgeting tools built in. Your employees can create their own budget, project their wage earnings based on their rostered shifts, view real-time earned wage calculations based on their approved hours, and set up payments into multiple bank accounts. With continuous award interpretation automatically applied, you ensure their pay is right and they get a true view of their financial position 24/7.

Let your employees access their earnings immediately

Your employees can immediately withdraw their available earned wages from anywhere at any time via their self-serve employee app. All they need to do is open and log into the app, tap on ‘Withdraw Now’ from the home screen, enter the amount they want to withdraw and follow the prompts. We also highlight the flat $5 transaction fee for transparency.

Improve employee wellbeing and improve your workforce

Talking about money can be hard and you can relieve financial pressure that you might not be able to see – simply by making cash flow sooner. Earned wage access can attract and retain staff, speed up the time to hire, and help you fill additional shifts – all the while providing a healthy alternative to expensive credit products and payday loans.

The impact of earned wage access

The results from a foundU customer survey on our earned wage access tool, Wageflo.

Frequently asked questions

Does earned wage access cost our business anything?

No. Wageflo is a financial health and wellbeing offering that you can provide your employees at no additional cost. We fund each early wage access withdrawal and then automatically apply the deduction and $5 transaction fee for the employee from their next pay slip.

Do I need to add tasks to payroll processing to facilitate earned wage access?

No. foundU automates everything Wageflo delivers from start to finish, leveraging the real time approved hours data and award interpretation automations that flow through the system. Simply turn the feature on and we take care of the rest.

Can I restrict earned wage access to specific employees?

Absolutely. You can select which employees are able to access their earned wages in case of emergencies.

Can I control the amount of earned wages that are accessible?

Yes, you can set a percentage of earned wages that will be available in each pay period.

What happens if an employee overdraws wages from their next pay slip?

We have guardrails in place to stop this from happening. You can set a percentage of earned wages that are available each period. Your employees can also see their available wages balance, projected earnings, and budget so they can withdraw their earnings appropriately.

"Many of our guards know and use the earned wage access feature to draw down on their wages before payday. Giving staff the ability to manage their own finances is the future of payroll, and I think, one of the great features of foundU."

- Mandeep Singh, General Manager at National Protective Services

Popular features that complement our earned wage access software

Employee Management

Our employee data management software keeps your records in sync. Every employee's rostered, worked, and approved shifts will be tracked against their profile, so they draw the right amount when they access their wages early.

Employee App

When you switch on earned wage access, employees will be able to withdraw their wages early via their mobile device. They can also create a personal budget and get a true view of their financial position via the convenient employee app.

Time and Attendance

foundU's time and attendance software makes clocking in and out a breeze. Once you approve a worked shift, the data flows straight through to payroll. Employees can then see their available earned wages in real-time.